In the race of life, most people undermine the importance of good health and then face healthcare problems out of the blue. The fast-paced lifestyle that we follow in India has reduced our physical activities, thereby making us lead a sedentary lifestyle. In terms of statistics, the approximate proportion of all deaths due to non-communicable diseases has risen to 61.8% – a significant jump from 37.09% in 1990. Amidst the rising uncertainties, term insurance seems like an easy way to build a financial cushion around our family members. The need for a suitable term plan is highly stressed upon in the current Covid-times. However, if there is anything that most people feel unsure about irrespective of their age or needs, it is the selection of sum assured in term insurance.

Before you help you out with the checklist to choose the right sum assured in term insurance, let’s start with the basic terminology.

What is Sum Assured in Term Insurance?

Sum assured in term insurance refers to the fixed amount payable to the nominee associated with the plan in case of the unfortunate demise of the insured. You can think of it as the maximum amount your family members will receive in your absence under your term insurance policy. It is one of the most crucial factors that determine the policy premium.

Recommended Read: All About Sum Assured Meaning

How to Calculate Sum Assured in Term Insurance?

Calculation of sum assured in term insurance basically implies assessing your financial needs to determine the maximum sum assured you should select. Although you might not find any sum assured calculator to do this, it would be easy if you can dig deeper to find out an approximate amount your family will need for their future needs in your absence.

The closest way to calculate the sum assured in term insurance is to first use a Human Life Value (HLV) calculator that is easily available online.

4-Point Checklist to Select the Right Sum Assured in Term Insurance?

Here’s a simple checklist you can follow to choose an adequate sum assured for your term insurance policy:

- List down the number of your future working years

- Get a fair idea of your regular annual expenses

- Assess major life goals

- Consider your savings, investments, and other liabilities if any

Let’s talk about each of these pointers in detail.

-

List down the number of your future working years

At the time of selecting sum assured in term insurance, most people realize that they are not resorting to term insurance to complete any checklist. In case you select an inadequate sum assured as it was available at a low premium, it may not be enough for your loved ones to survive and deal with their financial needs after.

On the other hand, selecting a very high sum assured implies a high premium that you may find difficult to pay. Since you will be paying the sum assured through your income, it makes sense to assess your remaining work life.

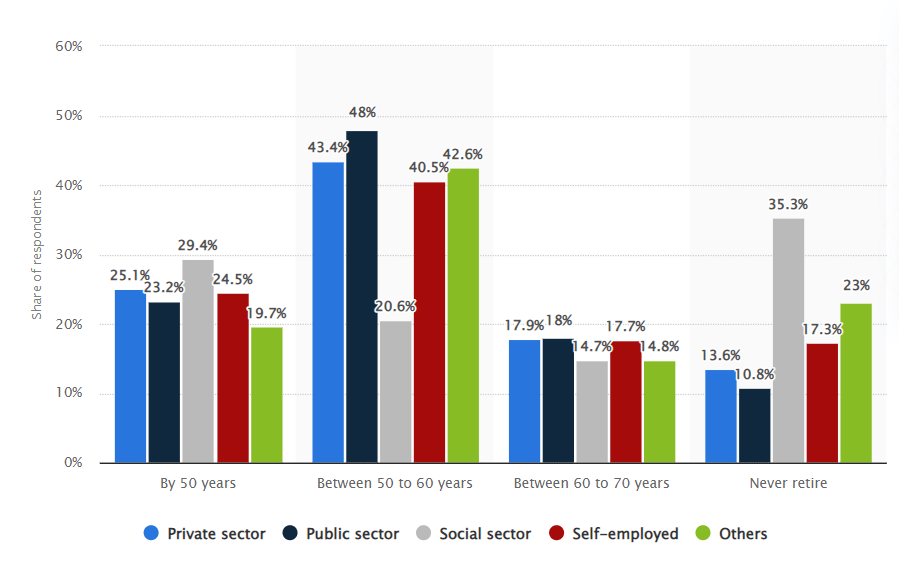

According to a survey conducted amongst young Indians, the majority of respondents belonging to different sectors preferred to retire between the age of 50 to 60 years.

For example, if your current age is 25 years and you want to retire at the age of 50, you still have 25 future earning years with you. Since term insurance purchase can also act as a tool for income replacement, knowing the future working years will help you determine the right sum assured in term insurance.

In case you have already purchased term insurance, you can ask the insurer for provisions to increase the sum assured in the term plan later in time.

-

Get a fair idea of your regular annual expenses

The primary objective of purchasing a term plan is to ensure that your family will not face financial hurdles after you. That is why you should have a clear idea of the current lifestyle and regular expenses needed to maintain the same. Since you need to pay the premium for the chosen sum assured in term insurance, it is also important to analyse how much money you can afford.

Start with noting down your major monthly expenses to find out how much money you can set aside for term insurance premiums. Also, keep in mind the inflation rate in the country while charting out these expenses.

Besides the insurance premiums you are paying currently, check if you can pay a little more to get adequate coverage with a high sum assured in term insurance.

-

Assess major life goals

As a working professional, you might have set several milestones and life goals to be achieved with hard work. Certain events in life like children’s marriage, their higher education plans in a foreign country, or your retirement asks for additional financial assistance. Hence, it is important that you consider them all while selecting sum assured in term insurance.

In case you want to retire early in life, you can also select term insurance with a return of premium to get both life cover and maturity benefits.

Also Read: What is Term Plan with Return of Premium?

-

Consider your savings, investments, and other liabilities if any

Your existing savings and investments can also be of great help for your family members in your absence. But on the other hand, the current financial liabilities may also fall upon them after you. To ensure that your loved ones can live well without making compromises, it is important for you to consider your savings, investments, and liabilities if any.

The right assessment of all the financial factors while selecting sum assured in term insurance can help you prevent their financial burden from falling onto your family.

What Else Should You Consider While Choosing Sum Assured in Term Insurance?

The selection of adequate sum assured in term insurance can help you lay the foundations of financial security in life. Other than the checklist detailed above, you are advised to consider the following aspects at the time of buying a term plan:

- Compare different term plans carefully before selecting one of them

- Check insurer’s reputation and genuine reviews

- Check for the availability of term insurance riders

- Check the claim settlement ratio of different insurers

- Carefully read the inclusions and exclusions related to the chosen term plan

- Ask about the claim filing process and the related ease

- Ask about the availability of round-the-clock customer support services

Read BimaBandhu to Select the Right Sum Assured in Term Insurance

For every individual, the financial definition of securing their family’s future is different. If you shoulder the financial responsibilities of your family members, it is important that you prepare well for it. The best way to find and buy the most suitable term insurance is to gain the right knowledge about how it works and can benefit you in the long run. This is where BimaBandhu can be of great help.

FAQs

-

How can I get a high sum assured in term insurance under my budget?

By comparing term insurance premiums online in relation to the sum assured, you can select the right life cover and pay an affordable premium over the chosen plan tenure.

-

Will sum assured in term insurance vary when I add riders?

It depends on the specific rider you select with your term plan. In general, every rider has its own features. To know more, ask the chosen insurance company.

-

Who is entitled to receive the chosen sum assured in case of the insured’s demise?

The selected nominee will get the sum assured in term insurance in such a scenario.

-

What is the maximum sum assured in term insurance?

It largely depends on your financial profile. The maximum sum assured you can select is based on the corresponding premium you can pay easily with your income.

-

What is the minimum sum assured in term insurance?

The minimum sum assured also depends on your income and job profile. In general, it depends on the chosen life insurance company in India.

-

What is the ideal sum assured in term insurance?

The ideal sum assured is the one that can give maximum financial protection to your loved ones without making it difficult for you to pay its premium.