Finding a suitable term insurance plan is no less than a necessity for people these days, particularly the breadwinners. The rising uncertainties and lifestyle diseases have made our lives shorter, as per data. However, to get the best value for money, you need the best term insurance plan. Whether it is the amount payable to the nominee in the event of death of the life assured, survival benefits, or premium, you should have a clear understanding of various term insurance parameters to buy the best term plan.

Wondering how to choose the best term insurance plans in India? Let’s get started.

Best Term Insurance Plan – True Definition

For every individual, the best term insurance plan is the one that can cater to his/her particular needs, irrespective of the list of features it has.

This term insurance definition might sound different from the ones who had previously read or heard about it. However, it says the exact truth people should know before selecting any term plan. Many of them often believe in the misconception that the best term insurance plans are those falling into such lists available online. Similarly, many others do not buy term insurance plans thinking it does not offer any maturity benefit.

Since different individuals have different needs and financial profiles, there are several types of term insurance plans available. Finding the best term plan in India is all about comparing your needs with the features and benefits of different available plans. The more matches you can relate to with a term insurance plan, the better it is for you.

Why Choose the Best Term Insurance Plan in India?

You should choose the best term insurance plan in India because you want to ensure maximum financial protection for your loved ones. With the best term plan by your side, you can get adequate insurance coverage at a price that falls within your budget. Besides this, the nominee can easily file a claim and receive the benefits of hassle-free claim settlement.

Once you have developed a good understanding of various aspects of term insurance, you can easily make an informed decision to select the best term insurance plan in India.

How to Choose the Best Term Insurance Plan?

Assess your individual needs

The first step to selecting the best term plan is to know what you need. Consider this simple example –

You were asked to buy green vegetables from the market. So, you went to the store and picked cucumber only. When you returned, you were told that this was not what they wanted but green peas or spinach.

Not knowing the exact needs can land anyone in trouble and the same holds true while buying a term plan. While most people know that they need a term plan, very few of them know exactly what they should look for.

By considering your needs, you will be in a better position to decide which is the best term insurance plan for you. In terms of needs, make a list of factors like your age, current health condition, income, and regular household expenses. Since you want to buy term insurance to help your loved ones after you are not around, you should assess all these factors first.

Make a checklist of popular term plans available

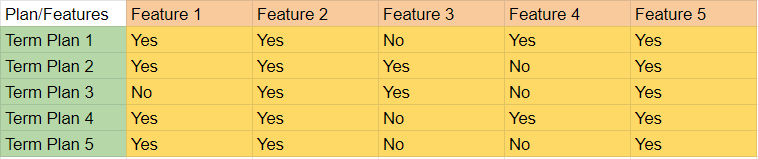

Once you know what your specific needs are, search online for the top-rated term insurance plans available in India. At this stage, avoid being in a hurry to select any of those plans. Instead, create a table that summarizes the best features of different term plans you have in your checklist.

Such a table will show you a better picture of all the benefits you can expect from different term insurance plans available. Out of them all, the best term insurance plan for you is the one that can fulfill all your needs without causing any financial hurdle.

If you think two-three term plans fit well with respect to your needs, continue reading to further zero in on the best term plan in India.

Check CSR of the chosen insurance provider

The next important thing is to check if the insurance provider offering the chosen term plans is reputable enough. Till now, you have listed the term plan(s) based on their features that correlate with your needs. But it is also important to check the market reputation of the insurer offering those plans.

It is where CSR or Claim Settlement Ratio comes into the picture. Think of it as the distinguishing factor between different life insurance companies in India. The higher the CSR, the easier it will be for you or your family members to get the claims settled on time.

Select the right sum assured

By this step, you have chosen the best term insurance plan offered by a renowned insurer. Now, you know which plan you want to buy for the financial well-being of your loved ones in your absence. However, the term plan selection process does not end here.

The next important step is about selecting the right sum assured. In insurance terminology, sum assured is the coverage amount the policy nominee receives after the death of the life insured. In other words, the primary benefits of the best term insurance plan are based on the sum assured you select.

Read more: How to Select the Right Sum Assured With Your Term Plan?

Select the right tenure – both policy and premium payment

Post selecting the sum assured, you need to select two types of policy-related tenures. The policy tenure is the duration for which your life will be covered under the chosen term plan. In case anything unfortunate happens to you during this period, the nominee will receive the term plan benefits.

On the other hand, premium payment tenure is the period for which you choose to pay the premium of your term plan. It can be as same as the policy tenure (for regular term plans) or shorter (for limited pay options).

Keep in mind that the combination of selected sum assured and these tenures will determine the premium payable for the best term insurance plan.

Select riders if any

Basically, riders are additional insurance sub-products that you can add to your term plan to get more benefits. Also, they are available at an additional cost over and above the basic premium you will be charged for the chosen plan.

The best thing is – it is up to you to decide if you want to select any rider. If not, just skip this step.

Pay the premium online

With all the required details by your side, you will be in a better position to select the best term insurance plan for yourself. You are advised to buy a term plan online which comes with several benefits, such as:

- Easy to compare different term plans online

- Easy to check term plan features and benefits before buying

- Availability of term plan premium calculators to get an estimate

- Comprehensive guides on term plan at BimaBandhu to make an informed decision

More about CSR

CSR refers to the number of claims settled by a life insurance company out of the total claims received in a year. In layman’s terms, the life insurance company with a comparatively high CSR should be your first preference.

How to Calculate CSR of Term Insurance Providers?

The calculation of CSR is mainly based on the following formula:

CSR = (Total number of claim settled) / (Total claims filed in a year)

Consider the following example to understand it better –

A life insurer received 10,000 claims in a financial year, out of which it settled 9,000 claims in the same year. Based on these details, the CSR becomes 90%.

A high CSR shows that you can trust the chosen insurer to buy the best term insurance plan. Furthermore, you should check the CSR of the insurer for the past four-five years. If it is increasing, it means the insurance company has done its part to serve the policyholders in a better way and is constantly improving.

List of Best Term Insurance Plans in India 2022

- Aegon Life iTerm Plan

- Aviva Lifeshield Advantage Plan

- Bharti AXA Term Plan eProtect

- Canara HSBC iSelect+ term plans

- Exide Life Smart Term Plan

- ICICI Prudential iProtect Smart

- LIC e-Term Plan

- Max Life Online Term Plan Plus

- SBI Smart Shield, amongst many others

Disclaimer: The above-listed term insurance plans are not endorsed, recommended, or rated by BimaBandhu.

Best Term Insurance Plans FAQs

What is the age limit to be considered while buying a term plan?

Individuals aged between 18 and 65 years can buy term insurance easily.

What should I look for while buying the best term insurance plan in 2022?

Check for the plan features, its premium, and insurer’s reputation while buying any plan this year.

Can I buy multiple term insurance plans?

As an individual, you can have multiple term insurance policies to build the financial safety net for your loved ones.

Which term insurance plan is best for 2022?

As stated above, you need to find the best term plan for yourself rather than relying on any list of the best plans.